FOR IMMEDIATE RELEASE

Cuero, Texas — January 10, 2026

A growing coalition of Cuero residents has issued a formal petition calling on the Cuero City Council to reconsider its December 8 approval of a 287(g) Memorandum of Agreement (MOA) with U.S. Immigration and Customs Enforcement (ICE), or to adopt clear, enforceable safeguards that protect civil rights, public safety, and community trust.

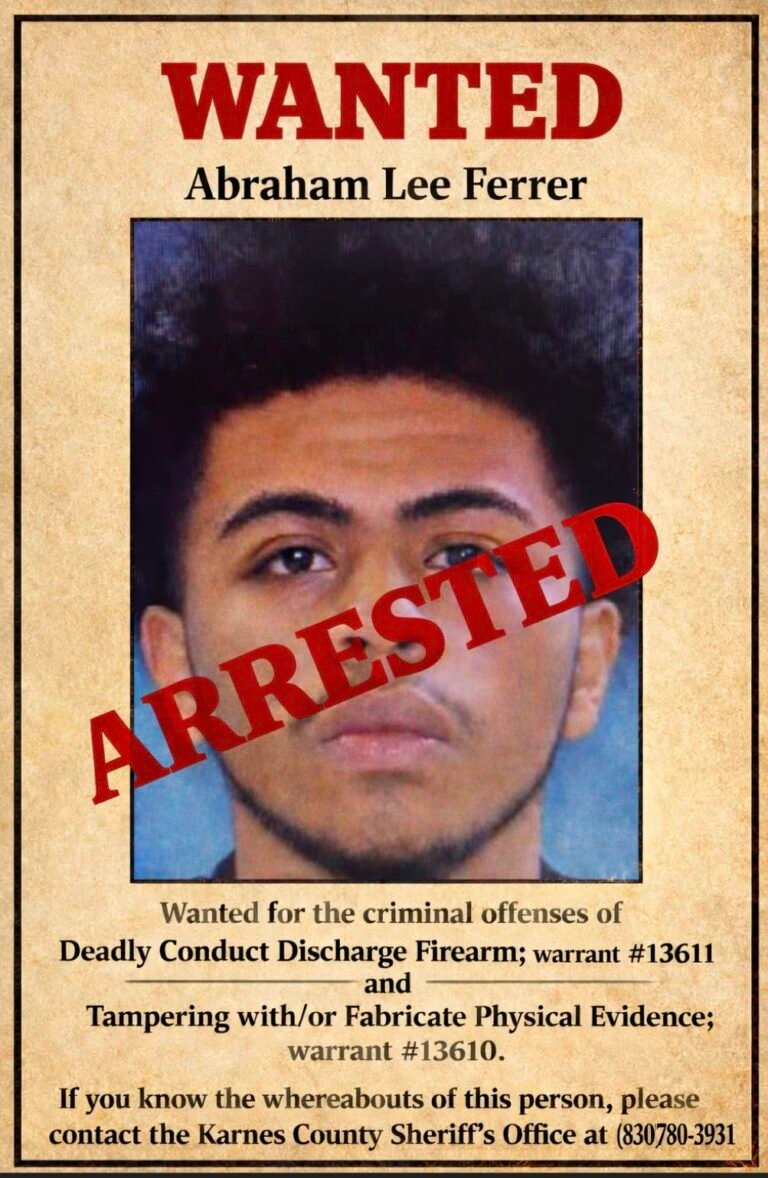

The petition follows the Council’s approval of the 287(g) agreement at the request of Cuero Police Chief Steve Ellis, who stated that the program would be used only to pursue violent criminals. However, the MOA contains no language limiting enforcement to violent or high‑risk offenders. Instead, it grants participating Cuero officers broad federal immigration‑enforcement powers under ICE supervision, including warrantless arrests, immigration questioning, detainer issuance, and the transport of individuals to ICE detention facilities.

Residents say the decision — made without public input, community outreach, or visible review of the agreement’s legal and civil‑rights implications — represents a major shift in local policing that demands transparency and accountability.

“Across the country, 287(g) programs have resulted in wrongful detentions of U.S. citizens, racial‑profiling complaints, and a chilling effect on crime reporting,” the petition states. “Cuero cannot afford to ignore this national record.”

The petition emphasizes that while the 287(g) program is legal under federal law, unconstitutional enforcement occurs when local agencies fail to set clear limits and oversight. Residents argue that if Cuero chooses to participate in the program, it must adopt local rules that keep enforcement focused, lawful, and accountable.

The petition outlines two possible paths forward:

1. Reconsider and pause implementation of the 287(g) agreement

A pause would allow time for public hearings, legal review, and meaningful community engagement.

OR

2. Adopt strong local safeguards, including:

• Limiting 287(g) enforcement to violent or high‑risk offenders

• Prohibiting immigration questioning during routine stops, minor infractions, or interactions with victims and witnesses

• Implementing anti‑profiling protections and interpreter access

• Requiring quarterly public reporting on all 287(g) activity

• Establishing independent community oversight

• Affirming that Cuero Police Officers must protect residents from anyone claiming to be a federal agent — including ICE — who does not identify themselves, show lawful authority, or present a warrant when required.

“These requests are not political,” the accompanying public statement reads. “They are about responsible governance, public safety, and protecting the civil rights of every resident.”

Residents emphasize that Cuero is a small community built on trust and relationships — and that any program with the potential to erode that trust must be implemented with caution, transparency, and clear limits.

The petition is now circulating throughout Cuero and DeWitt County, with organizers encouraging broad participation from residents of all backgrounds.

DISCLAIMER

Some supporters have chosen to remain anonymous due to safety or privacy concerns. Their identities have been verified privately by the petition organizer. All signatures represent real individuals residing in the affected community. Their names will never be publicly posted or published (There is an option at the bottom of the petition that allows you to hide your name). To add your name to the petition, click on the following link: https://c.org/56BzVq6jn6