Robert Leon Oliver, close friend and relative to many in the DeWitt County community, passed away peacefully on June 8, 2025. Robert was an esteemed citizen of DeWitt County, a generous philanthropist and the founder and Chairman of the Board of the Chisholm Trail Heritage Museum. He has left a profound legacy of love and commitment not only to his family and friends, but for the entire city of Cuero. He was born in Refugio, Texas on August 8, 1949, to Gale Oliver Jr. and Frances Hamilton Oliver. Besides his loving parents, Robert was greatly influenced by his maternal grandmother, Clare Wofford Hamilton of Cuero.

From a very young age, Robert had a keen appreciation and curiosity about his family history. He spent many memorable summers and holidays with his grandparents at their ranch in Cheapside Texas. Through the years, he came to respect his family’s rich ranching heritage and deep ties to the land. After graduating from Refugio High School, Robert followed his older brother Alex, breaking with family tradition and instead of becoming an Aggie, he enrolled at the University of Texas at Austin. While at the University of Texas, Robert became a member of the Acacia Fraternity and the University of Texas Longhorn Marching Band. Robert graduated with a Bachelor of Journalism degree in Advertising Studies.

After graduation from College, Robert moved to Vail, Colorado. He had a strong desire to travel and explore the world, so he took a job in a restaurant until he earned enough money for his first trip to Europe. That trip awakened his passion for travel, architecture, art, beautiful gardens and especially history; all of which he cultivated throughout his lifetime prompting his desire to renovate, restore and repurpose almost every historical building he ever saw! Following his travels to Europe and Asia, he came back to Vail where he first managed a small boutique hotel. It’s then he started his career in real estate management. He became owner and president of the Plaza Lodge Properties in Vail, a property management company consisting of townhomes, condominiums, private homes and commercial buildings. While living in Vail, Robert served on the founding board of the Betty Ford Alpine Gardens, a 1.5 acre high altitude garden consisting of athletic fields and a custom playground for children.

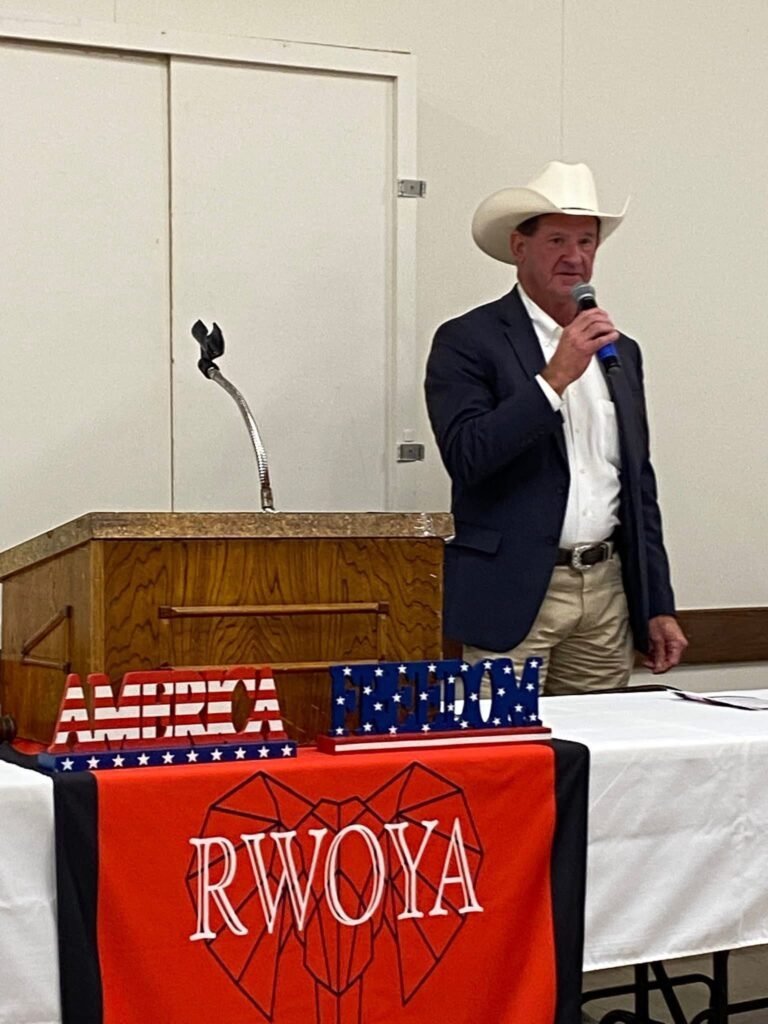

After returning to Cuero in 1995 to help care for his mother, Robert rekindled former acquaintances and made new friendships as he settled into a small community. He became active in historic preservation right away and was Chairman of the Cuero Heritage Museum from 1998 to 2001 where he curated many exhibits. His passion for history and ranching heritage guided his dream to establish a museum dedicated to the ranching heritage of South Central Texas. In 2000, he led stakeholders and community leaders in establishing the Chisholm Trail Heritage Museum. Through his leadership and tireless efforts, they created a mission statement, organized by laws, navigated application and authorization processes, led two capital campaign efforts, obtained and oversaw restoration of the Knights of Pythias Hall and construction of a two story annex adjacent to the hall. The museum opened its doors in 2013, and Robert has been instrumental in the success of the award winning museum since its inception. His vision has grown to include several other historical structures on the museum campus as well as Peebles Park and the Steen Roundabout. Always striving to improve things, Robert’s future plans included a major expansion to the museum that will house Native American artifacts, Texas pioneer items and Western Art. His goal and driving force was always to create spaces that draw people from all walks of life together to enjoy each other, learn new things and celebrate the history and heritage of the community.

Robert was a prolific visionary, a lover of art and music with a profound passion to experience, notice, appreciate, savor, teach and share the many examples of the arts and culture he found all around him with friends, family and especially his nieces and nephews. He generously took many opportunities to spend his time and knowledge with them, sharing his love of the arts, never missing an opportunity to get together and just generally having a great time! He was also a man of the land. His dedication to caring for and improving the landscapes around him was endless.

Robert was preceded in death by his parents, Frances and Gale Oliver Jr.; his brothers, Gale Oliver III (Gay) and Alexander Hamilton Oliver (Nance).

He is survived by his partner, Hebert Rojas-Silva; brother, William Thornton Oliver (Coylene); nieces, Kathy Oliver (Brian Chandler), Kristen Jesulaitis (David), Clare Duffin (Donald), Amory Felder (Robby) and nephews, Gale Hamilton Oliver (Tricia), Will Oliver (Leslie), and Greyson Oliver. He adored his great nieces and nephews, Elizabeth, Clare, Parker, Will, Jackson, Kyle, Oliver, Tripp, Porter, Anderson, Tillie and Hamilton.

A private family service will be held for Robert with burial to follow at Hillside Cemetery. At a later date there will be a Celebration of Life to honor Robert on the campus of the Chisholm Trail Heritage Museum.

In lieu of flowers, the family request that donations be made to the Robert Oliver Memorial at the Chisholm Trail Heritage Museum or the charity of your choice.